Whittlesey & Hadley Joins BlumShapiro Among Nation’s Top 200 CPA Firms

/Whittlesey & Hadley, P.C., one of the area's largest regional accounting firms, ranks #192 in the Inside Public Accounting (IPA) fifth annual ranking of the Top 200 public accounting firms in the United States. It is the firms’ debut appearance on the industry ranking list.

West Hartford-based BlumShapiro was the highest ranked Connecticut headquartered public accounting firm, ranking at #56, up from #68 a year ago. BlumShapiro and Whittlesey & Hadley are the only Connecticut-based firms among the top 200.

Inside Public Accounting (IPA), founded in 1987, is published by The Platt Group. The Platt Group publishes both the award-winning Inside Public Accounting newsletter and the award-winning National Benchmarking Report.

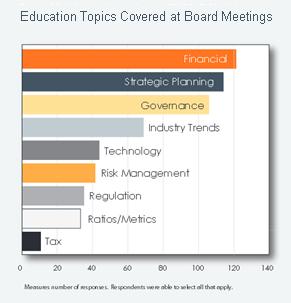

The top 10 firms – ranked by U.S. net revenue - include some well-known national names, and large regional firms not well known by businesses and consumers outside their regions. The top 10 are: Deloitte, PwC, Ernst & Young, KPMG, McGladrey, Grant Thornton, BDO USA, Crow Horwath, CliftonLarsonAllen, and CBIZ & Mayer Hoffman McCan. CohnReznick, which has a footprint in Connecticut (including a recent consolidation of suburban offices in downtown Hartford) ranked at #11.

Whittlesey & Hadley’s managing partner, Drew Andrews says, “We are pleased to see our firm join this prestigious list of growing CPA firms in the United States. This ranking represents our strategic plan to expand our professional services and talented team throughout the northeast.”

BlumShapiro was also named among the fifty “Best of the Best” by the publication, a category described as firms that “show strong growth and profitability, and rank high on numerous key metrics, they also demonstrate an enviable culture. These Best of the Best firms are at the top of their game.”

“We are honored to be recognized for this prestigious award,” said Carl Johnson, BlumShapiro Firm Managing Partner. “To be distinguished as one of the best firms … is a testament to the teamwork, leadership and vision of all employees at BlumShapiro,” said Johnson. BlumShapiro is the largest regional accounting, tax and business consulting firm based in New England, with offices in Connecticut, Massachusetts and Rhode Island.

According to the publication, net revenue at Whittlesey & Hadley grew by 7.9 percent from the previous year; at BlumShapiro up 6.5 percent.

“With more than 540 firms participating in the IPA annual Survey and Analysis of Firms this year, along with many CPA firm associations contributing to the search to identify the IPA 200, this (is) the definitive ranking of the nation’s largest public accounting firms,” said Kelly Platt, principal of The Platt Group, the publisher of IPA.

“With more than 540 firms participating in the IPA annual Survey and Analysis of Firms this year, along with many CPA firm associations contributing to the search to identify the IPA 200, this (is) the definitive ranking of the nation’s largest public accounting firms,” said Kelly Platt, principal of The Platt Group, the publisher of IPA.

A mong the industry trends cited by the publication are tighter margins, leadership changes, globalization, new regulations, acquisition pressures, evolving technology, cultural shifts, fierce competition, and commoditization of services (firms struggling to differentiate in the marketplace).

mong the industry trends cited by the publication are tighter margins, leadership changes, globalization, new regulations, acquisition pressures, evolving technology, cultural shifts, fierce competition, and commoditization of services (firms struggling to differentiate in the marketplace).

Three firms earned positions in the Top 100 for the first time, and 12 firms – including Hartford’s Whittlesey & Hadley – debut on the Top 200 list.

Other industry trends, as highlighted by Inside Public Accounting:

- Cultural shifts – Younger employees often have different motivations and expectations than their elders at the firm. Up-and-comers who have “the right stuff” aren’t willing to wait the traditional 12 to 15 years to become partner and will challenge the firm to re-think normal career paths.

- Lack of diversity among partners – The ever-diversifying population – in age, ethnicity, language and gender – is not reflected in the makeup of the owners of accounting firms and change is glacially slow.

- Work environment challenges – Technology makes it possible for professionals to work anytime, anywhere. Balancing the needs of the individual with the needs of the firm, colleagues and clients can be tricky.

The IPA 200 are also engaged in acquisitions to grow in size, scope and capability, with 21 mergers reported for the group last year, adding more than 200 staff and more than $22 million into the aggregate numbers of the group.

ss are Torrington, Danbury, West Hartford, Cheshire, Guilford, Greenwich, Plainville, Middlebury, New London, Killingly, Middletown, Fairfield, Madison, Branford, Farmington, Glastonbury, Windsor, Orange and East Hartford.

ss are Torrington, Danbury, West Hartford, Cheshire, Guilford, Greenwich, Plainville, Middlebury, New London, Killingly, Middletown, Fairfield, Madison, Branford, Farmington, Glastonbury, Windsor, Orange and East Hartford.

rth. In Wyoming the gap is 37.1 percent, in New Hampshire 38.6 percent, and in South Dakota, 39 percent. In South Dakota, with the widest gap, only 10.9 percent of the wage earners in the top one percent are women.

rth. In Wyoming the gap is 37.1 percent, in New Hampshire 38.6 percent, and in South Dakota, 39 percent. In South Dakota, with the widest gap, only 10.9 percent of the wage earners in the top one percent are women. reas such as New York, Philadelphia, Chicago, Boston, Atlanta, and Washington.

reas such as New York, Philadelphia, Chicago, Boston, Atlanta, and Washington.

nd Connecticut Coalition of Mutual Assistance Associations. The project was also supported by the Asian American Studies Institute at UConn, the UConn School of Pharmacy and the UConn School of Social Work. It focused on housing, education, language access, employment, access to public resources, and medical and mental health.

nd Connecticut Coalition of Mutual Assistance Associations. The project was also supported by the Asian American Studies Institute at UConn, the UConn School of Pharmacy and the UConn School of Social Work. It focused on housing, education, language access, employment, access to public resources, and medical and mental health. Healthcare Concerns

Healthcare Concerns d education, promoting preventative care, actively recruiting APA members in various professional fields, creating diversity in the workforce, translating materials into the most common APA languages, and raising awareness among the APA population regarding their rights.

d education, promoting preventative care, actively recruiting APA members in various professional fields, creating diversity in the workforce, translating materials into the most common APA languages, and raising awareness among the APA population regarding their rights.

RS website

RS website

In addition to Davidson, expert panelists participating include Carissa Ganelli, Founder & CEO, LightningBuy; Drue Hontz, Founder & President, KAZARK, Inc.; John Nobile, Founder & President, Tangen Biosciences; and Nadav Ullman, Founder & CEO, Dashride.

In addition to Davidson, expert panelists participating include Carissa Ganelli, Founder & CEO, LightningBuy; Drue Hontz, Founder & President, KAZARK, Inc.; John Nobile, Founder & President, Tangen Biosciences; and Nadav Ullman, Founder & CEO, Dashride. nt of strategy and operations for Global Market Development in Qualcomm Technologies, Inc. In this role, he handles reporting and operations as well as executing on strategic global business initiatives. In addition, Davidson is senior vice president of investor relations where he serves as the primary liaison with the investment community and Qualcomm shareholders. Davidson has more than 25 years of experience in technical sales, marketing and general management roles in the telecommunications industry.

nt of strategy and operations for Global Market Development in Qualcomm Technologies, Inc. In this role, he handles reporting and operations as well as executing on strategic global business initiatives. In addition, Davidson is senior vice president of investor relations where he serves as the primary liaison with the investment community and Qualcomm shareholders. Davidson has more than 25 years of experience in technical sales, marketing and general management roles in the telecommunications industry. naging Partner & Principal, New England Consulting Group.

naging Partner & Principal, New England Consulting Group.