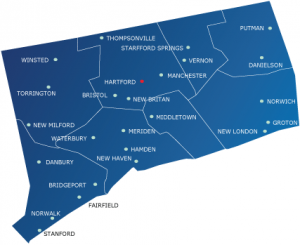

What do Houston, Los Angeles, New Orleans, Chicago and Hartford have in common? Each has been selected to serve as host for the Museum Store Association’s annual Retail Conference & Expo. Hartford will have the honors in 2015, having just been selected by the association’s site selection committee for their 60th Annual event.

The four-day conference, to be held at the Connecticut Convention Center April 17-20, 2015, is expected to bring in 900 participants downtown, representing over 500 museums, other cultural institutions, and companies with products and services of interest to the museum store industry. Officials anticipate 1,130 room nights and 360 peak nights will be booked by attendees next spring.

It is the only conference and expo specifically created for retailers at museums, historic sites, botanic gardens, aquariums, zoos, libraries and more. The annual show provides a valuable opportunity for members of the association to network, learn and source vendors and products to complement their institutional collections.

Among the 11 institutions and nine vendors that are Hartford-area members of the association are the Wadsworth Atheneum Museum of Art, Connecticut Historical Society Museum & L ibrary, Harriet Beecher Stowe House, New Britain Museum of American Art and Friends of Dinosaur State Park and Arboretum.

ibrary, Harriet Beecher Stowe House, New Britain Museum of American Art and Friends of Dinosaur State Park and Arboretum.

The Museum Store Association (MSA) is bringing its annual conference to the Northeast for the first time in more than a decade. They met in Philadelphia in 2003. Given the number of members and vendor affiliates on the East Coast - and especially in the northeast - the organization’s leadership determined it was time to head east. Within an 11-state region in the Northeast, there are more than 200 institutions and 100 industry vendors that are members of MSA.

Stacey Stachow, President of the Board of Directors of MSA and Manager of the Wadsworth Atheneum Museum Shop, was especially pleased with the choice. “Connecticut has so much to offer with its rich cultural history, so many museums and things to do that relate to our members.”

It is expected that a Hartford-based committee will help plan activities that will involve the local members of MSA. Those plans will likely include educational sessions, networking events, tours to local museums, historical sites and other institutions of interest, and the organiation’s membership meeting and silent auction.

In selecting Hartford, MSA officials cited the convenience of travel, affordability, cultural institutions in and close to the city, and Hartford’s “pedestrian-friendly” layout as factors in the selection process. Having a 4-star hotel interconnected with a modern Convention Center was also a plus.

MSA is a nonprofit, international association organized to advance the success of museum retail professionals. By encouraging high standards of professionalism, MSA helps cultural commerce professionals better serve their organizations. MSA also is focused on helping increase awareness about museum stores as unique shopping destinations for tourists and cultural travelers. The event features hundreds of booths showcasing the unique items for museum store and MSA-represented institutional buyers.

Jama Rice, MBA, CAE, Executive Director/CEO at MSA, reflected about the site-selection for the 2015 program: “I’d attended a conference in Hartford years back, and found it to be both charming and intimate.” Ms. Rice, who joined MSA in 2013, continued, “The area offers so many advantages from a rich museum culture to close proximity to both New York and Boston, a convenience for that concentration of institutional members and vendor affiliates across the Northeast. It’s also easily accessible to those traveling from across the country or coming in from overseas.”

“We are excited to host the Museum Store Association for their 60th Annual Retail Conference & Expo next April,” state d Michael Costelli, General Manager for the Connecticut Convention Center. “The program will utilize much of the meeting and exhibit space at the Center and we are confident attendees will appreciate the countless cultural attractions located right here in Hartford.”

d Michael Costelli, General Manager for the Connecticut Convention Center. “The program will utilize much of the meeting and exhibit space at the Center and we are confident attendees will appreciate the countless cultural attractions located right here in Hartford.”

Although this year’s conference in Houston is still months away, the MSA has already begun to promote next year’s event, highlighting Hartford on the organization’s website: “As the fourth-largest city in Connecticut, Hartford is not only home to the state’s capital, but it is the birthplace of the Boys & Girls Club, the first FM station to begin broadcasting in the world and President Theodore Roosevelt’s first automobile ride. An 18-square-mile city, Hartford is home to 125,000 residents, world-class dining, international cultural attractions and award-winning entertainment venues.”

ation of wealth in the United States is along the Interstate 95 corridor – including in Connecticut, which ranked #3 in the nation.

ation of wealth in the United States is along the Interstate 95 corridor – including in Connecticut, which ranked #3 in the nation. reach the top 10.

reach the top 10. uns the Phoenix Global Wealth Monitor, told the Washington Post.

uns the Phoenix Global Wealth Monitor, told the Washington Post.

d Michael Costelli, General Manager for the Connecticut Convention Center. “The program will utilize much of the meeting and exhibit space at the Center and we are confident attendees will appreciate the countless cultural attractions located right here in Hartford.”

d Michael Costelli, General Manager for the Connecticut Convention Center. “The program will utilize much of the meeting and exhibit space at the Center and we are confident attendees will appreciate the countless cultural attractions located right here in Hartford.” are Month (National Association for Home Care & Hospice) and National Hospice Month (National Hospice and Palliative Care Organization), as well as Great American Smokeout Month. November 21 is designated by the American Cancer Society as the Great American Smokeout Day.

are Month (National Association for Home Care & Hospice) and National Hospice Month (National Hospice and Palliative Care Organization), as well as Great American Smokeout Month. November 21 is designated by the American Cancer Society as the Great American Smokeout Day.