More Changes Proposed as Enrollment Drops at State Colleges, Universities; Feedback Sought on Consolidation Plan

/The recent decision by the Board of Regents of the Connecticut State Colleges & Universities (CSCU) to begin offering students from New York and New Jersey the considerably lower in-state tuition rates in an effort to stem an increasing drop in enrollment at Western Connecticut State University may be the tip of the iceberg.

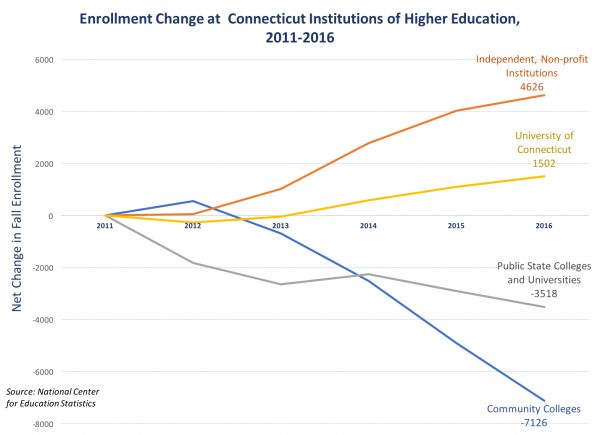

Since 2011, enrollment numbers at higher education institutions in Connecticut have been moving in very different directions, according to data developed by the Connecticut Conference of Independent Colleges (CCIC) from the National Center for Education Statistics.

The data show that the state’s community college system has experienced a net loss of 7,126 students, and the state’s four regional universities – Western, Central, Southern and Eastern Connecticut – saw a net loss of 3,518 students between 2011 and 2016.

Trending in the opposite direction has been the University of Connecticut, with a net increase of 1,502 students, and the independent, non-profit institutions, was an increase of 4,626 students.

CCIC member institutions include Albertus Magnus College, Connecticut College, Fairfield University, Goodwin College, Mitchell College, Quinnipiac University, Rensselaer at Hartford, Sacred Heart University, St. Vincent's College, Trinity College, University of Bridgeport, University of Hartford, University of New Haven, University of Saint Joseph, Wesleyan University and Yale University.

Currently, in-state students pay $10,418 in annual tuition at Western, while out-of-state students pay $23,107. Published reports indicate that enrollment at the university has dropped by more than 700 students over the past six years. The university serves about 5,700 students, with more than 90 percent of them coming from Connecticut.

Similar initiatives at the other three colleges are less likely, as they are located in Willimantic, new Haven and New Britain, not adjacent to any state line. Central Connecticut State University is the largest of four universities within the CSCU system, serving nearly 11,800 students--9,800 undergraduates, and 2,000 graduate students.

Last year, in a program that was promoted with radio advertising, the CSCU board approved a plan that permitted Asnuntuck Community College in Enfield to admit students from Massachusetts to enroll at in-state rates. And last spring, the board allowed six other community colleges located near state borders to do the same starting this fall. The plan boosted enrollment at Asnuntuck; data on the other colleges is not yet available.

Earlier this year, the CSCU system proposed merging the 12 community colleges into one college with 12 branch campuses, as a cost-saving measure, and, officials say, to direct more resources to students. That plan is pending. If approved, the change would make the newly named Connecticut Community College the fifth largest in the country with more than 52,000 students, reports indicate. Officials indicate that "Only a few of these recommendations will require policy changes by the Board of Regents. The majority of the administrative recommendations can be implemented as soon as time and resources are available to complete."

Currently, the system is soliciting feedback on the proposal with an on-line poll on the CSCU website. The survey asks respondents to offer opinions on the plans, as well as suggestions and opinions on strengths of the 12 into 1 plan. The survey is open until Nov. 20.

Memo of Understanding to get have 150,000 EVs on Connecticut roads by 2025.

Memo of Understanding to get have 150,000 EVs on Connecticut roads by 2025.

Venture capital firms are typically deep-pocketed, small companies that bet on startup success by investing millions in exchange for an ownership interest and hopes of high returns. Published

Venture capital firms are typically deep-pocketed, small companies that bet on startup success by investing millions in exchange for an ownership interest and hopes of high returns. Published

Sponsor), Eversource (Gold Sponsor), AT&T (Gold Sponsor), Accounting Resources, Inc. (Silver Sponsor), Qualidigm (Silver Sponsor), CT by the Numbers (Silver Sponsor), and Aeton Law Partners (Silver Sponsor). The David Alan Hospitality Group and Capture provided in-kind services.

Sponsor), Eversource (Gold Sponsor), AT&T (Gold Sponsor), Accounting Resources, Inc. (Silver Sponsor), Qualidigm (Silver Sponsor), CT by the Numbers (Silver Sponsor), and Aeton Law Partners (Silver Sponsor). The David Alan Hospitality Group and Capture provided in-kind services.

nts have been selected to receive the prestigious awards, including organizations and initiatives from

nts have been selected to receive the prestigious awards, including organizations and initiatives from

“The Entrepreneur Innovation Awards seek to give new and growing companies the support they need to thrive,” said Glendowlyn Thames, executive director of CTNext. “Through these events, we have seen a number of incredible companies that are changing their respective industries and creating a positive economic impact in our state. These grants continue to support companies at the earliest stages of growth and to drive them to the next level of development.”

“The Entrepreneur Innovation Awards seek to give new and growing companies the support they need to thrive,” said Glendowlyn Thames, executive director of CTNext. “Through these events, we have seen a number of incredible companies that are changing their respective industries and creating a positive economic impact in our state. These grants continue to support companies at the earliest stages of growth and to drive them to the next level of development.”