CT Aims to Keep Ultra-Wealthy in State; Tracks Tax Payments of 100 Top Earners

/Connecticut is ranked second in the nation in the number of millionaires per capita. Only Maryland has more. But with Connecticut’s precarious financial situation amidst what has been described as a “new economic reality,” any drop in the plethora of extremely wealthy residents can almost instantly have far-reaching consequences, officials say. In Connecticut, as well as California, Maryland and New Jersey, the top 1 percent pay a third or more of total income taxes, The New York Times reported this month. “There's an outmigration trend. It's real,'' Sullivan recently told The Hartford Courant, describing the departure of wealthy residents from Connecticut.

But Connecticut is not sitting idly by. The state is trying to keep its wealthy residents right here in the Land of Steady Habits.

Connecticut, the Times reported, now tracks the quarterly estimated payments of 100 of its top earners. State Revenue Services Commissioner Kevin B Sullivan told Inside Wealth columnist and CNBC wealth editor Robert Frank that about five or six of the highest earners could have a "measurable impact on the revenue stream."

By way of example, Sullivan said that when one of the state's rich hedge fund executives planned to move his family and company to a lower-tax state, state officials met with him and persuaded him to leave some of his work force in Connecticut, the Times reported. "We knew we were going to lose him," Sullivan said, "but we wanted to keep some of the higher-paying jobs."

He added, “We advised him that there are ways to be close to family and friends in Connecticut on occasion that are perfectly legal. We're trying to send a more welcoming message to the high earners as a group." Homeowners who spend more than 183 days in the state are considered residents for tax purposes.

He added, “We advised him that there are ways to be close to family and friends in Connecticut on occasion that are perfectly legal. We're trying to send a more welcoming message to the high earners as a group." Homeowners who spend more than 183 days in the state are considered residents for tax purposes.

The top 10 states in millionaires per capita, after Maryland and Connecticut, are Hawaii, New Jersey, Alaska, Massachusetts, New Hampshire, Virginia, Delaware and the District of Columbia, according to Phoenix Marketing International’s Global Wealth Monitor.

Earlier this year, the Courant reported that one of three Connecticut residents with an 11-figure net worth, according to the latest Forbes magazine list of the  wealthiest individuals, had relocated from Greenwich to Florida, the second individual in that tax bracket to do so recently. The exits, the Courant reported, “leave Connecticut with 13 billionaires, including Ray Dalio ($15.6 billion) and Steven Cohen ($12.7 billion), both hedge fund owners who live in Greenwich.” Eight of those 13 state residents list Greenwich as their home address, according to Forbes.

wealthiest individuals, had relocated from Greenwich to Florida, the second individual in that tax bracket to do so recently. The exits, the Courant reported, “leave Connecticut with 13 billionaires, including Ray Dalio ($15.6 billion) and Steven Cohen ($12.7 billion), both hedge fund owners who live in Greenwich.” Eight of those 13 state residents list Greenwich as their home address, according to Forbes.

Connecticut is not alone in keeping a watchful eye on its billionaires. New York is now more closely monitoring wealthy taxpayers who have homes in New York but claim Florida as their tax residence. And New Jersey is collecting data on all of the taxpayers who make more than $1 million to forecast their tax payments more accurately, the Times reported.

As is true in a number of states with wealthy residents, including New York, New Jersey and California, even as some of the state's wealthiest residents head to warmer climates and more favorable tax structures, the number of millionaires in the state grows.

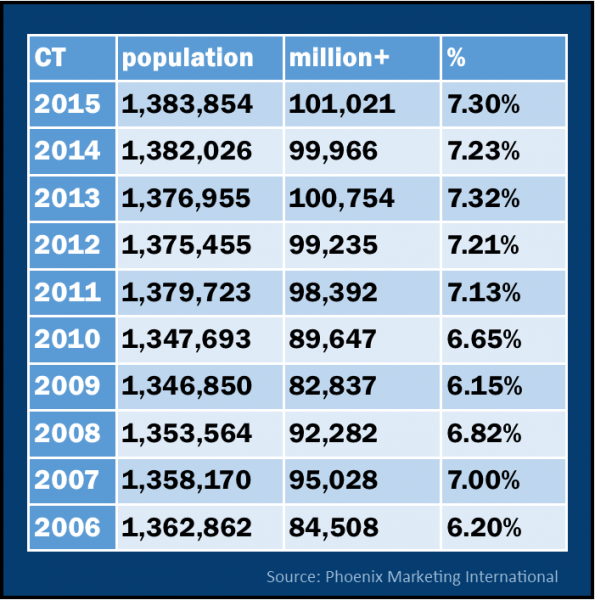

Just three years ago, in 2013, the number of millionaires in Connecticut topped 100,000 for the first time. In 2015, it exceeded 101,000. That compares with just over 84,000 in 2006. Millionaires made up 6.2 percent of state residents that year, compared with 7.3 percent in 2015, based on data from Phoenix Marketing International.